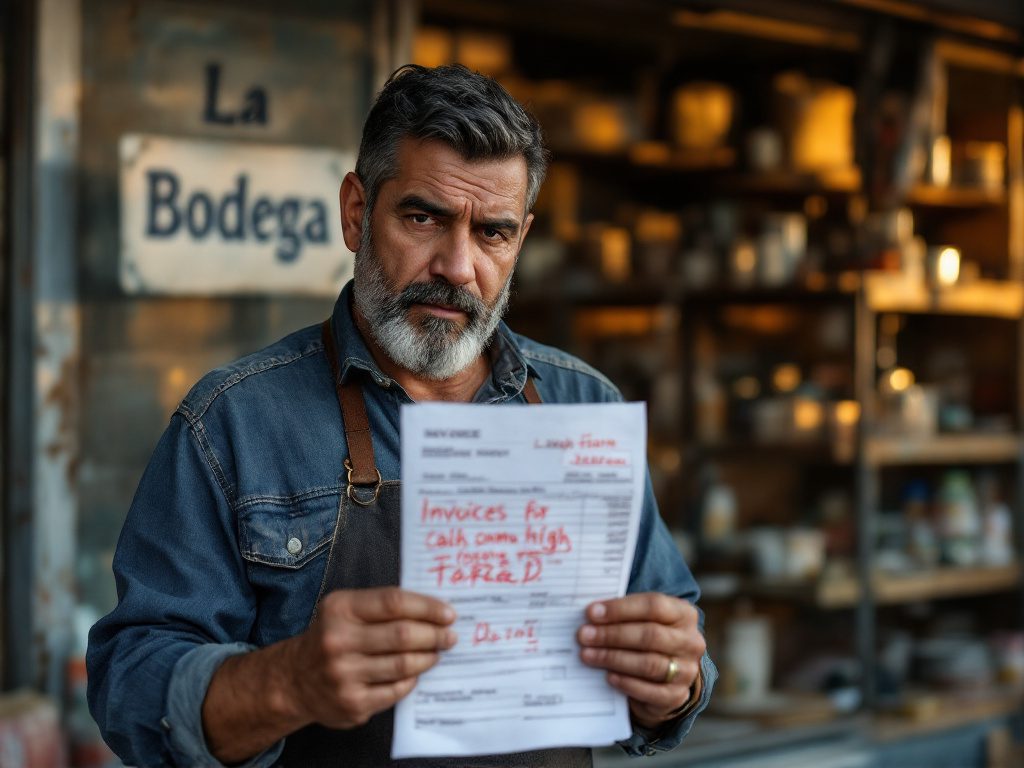

Demands from Main Street: Tariffs Threaten America’s Economic Backbone

In a country where small businesses are often called the engine of the American economy, you’d think their voices would ring loudest in the corridors of power. Yet when the U.S. Chamber of Commerce—a group hardly known for alarmist rhetoric—calls for immediate and automatic tariff exemptions to stave off a recession, it’s clear something is truly amiss. The Chamber’s letter, addressed to President Trump and key administration officials, describes a landscape where tariffs aren’t just numbers on a spreadsheet, but existential threats to the livelihoods of millions.

The Chamber’s CEO, Suzanne Clark, didn’t mince words. Tariffs, she warned, exacerbate costs, snarl already fragile supply chains, and create burdens that small businesses—unlike corporate giants—simply cannot bear. Items as ubiquitous as cocoa, bananas, and industrial inputs face price hikes, and alternatives can’t be sourced locally or quickly. While the White House maintains that tariffs are strategic levers to rebalance the playing field, those on Main Street are being left with shrinking margins and tough decisions.

Clark isn’t alone in sounding the alarm. According to a 2023 National Federation of Independent Business (NFIB) survey, nearly 37% of American small business owners reported that tariffs—and the resulting supply disruptions—had made it significantly harder to plan for the future. Many reported stalled hiring or layoffs, undermining the bedrock of local economies.

Political Gambits Versus Real-World Consequences

Beyond that, what’s at stake is not theoretical economic policy, but the everyday realities of real people and communities. With both the U.S. and China imposing tit-for-tat tariffs, some rates rising above 100%, small businesses reliant on imported components or exports have found themselves squeezed on both sides. The administration, for its part, defends tariffs as calculated pressure points, designed to nudge companies into reshoring jobs and investments.

Yet, this strategy glosses over the unpredictable collateral damage—families losing incomes, communities facing closures, and local economies deprived of their lifeblood. Harvard economist Dani Rodrik notes, “We should remember that blanket tariffs increase costs for consumers, stoke inflation, and—when applied without flexibility—can backfire by inviting retaliation.” American farmers, already struggling, have been hit particularly hard, with overseas buyers vanishing overnight. Those ripple effects reach all the way from rural fields to urban storefronts.

Chamber president Suzanne Clark underscored the urgency: “Automatic tariff exemptions for small businesses are not about weakening America’s trade position, but about preventing irreparable harm to businesses, workers, and families in every state.”

“Many small businesses will suffer irreparable harm,” the U.S. Chamber of Commerce warned, urging the administration to act before communities across the country feel the pain of tariffs not intended for them.

The White House, meanwhile, has offered little beyond the promise of potential tax cuts. Deputy Chief of Staff Steven Miller stated bluntly that exemptions aren’t on the table, even as the Chamber’s letter pleads for a straightforward, fast “tariff exclusion process” when jobs are threatened. This disconnect between Wall Street rhetoric and Main Street reality has consequences: small manufacturers can’t simply pivot their sourcing overnight, nor can corner stores pass on dramatic price spikes to already-strained customers.

Progressive Alternatives: Balancing Prosperity with Fairness

A closer look reveals the shortcomings of protectionist, one-size-fits-all policies that fail to account for America’s economic diversity. While reducing unfair trade practices is a worthy goal, the current climate highlights why blanket tariffs are a blunt and often counterproductive tool. Expert testimony before the Senate Committee on Small Business earlier this year cited case after case of entrepreneurs slashing jobs, halting expansion, or even shuttering entirely—direct fallout from broad-brush tariffs that make no distinction between global mega-firms and the corner bakery.

Calls for reform aren’t about coddling business interests, but about supporting the very people and places that embody American resilience: the family grocer, the local manufacturer, the coffee shop owner fighting to keep the doors open. Smart trade policy, say most progressive economists, should marry tough negotiation with swift, evidence-based relief when collateral damage threatens American values of economic inclusion and shared prosperity.

Recent history provides a cautionary tale. The Smoot-Hawley Tariff Act of the 1930s, enacted with similar short-term logic, deepened the Great Depression by strangling imports and inviting foreign retaliation. That lesson remains seared into the minds of those who have studied the cycles of protectionism and recession. It’s not enough to promise tax cuts when the immediate damage from tariffs is clear and mounting.

So where do we go from here? Honest, pragmatic leadership would mean listening to those on the frontlines—creating tailored exemptions, streamlining processes, and building in rapid response tools to adjust policy when unintended harms emerge. Real economic patriotism is not about sacrificing our smallest, most vulnerable businesses at the altar of great-power posturing, but rather about helping them survive, adapt, and compete on a fairer field.

The Chamber’s plea is not a partisan talking point—it’s a demand for policy rooted in reality, compassion, and the promise of American opportunity. Ignoring that demand would not just risk recession; it would undermine the values of equality, entrepreneurship, and hope that define the nation at its best.